S corp payroll calculator

The following are some of the ways we employ to ensure customer confidentiality. LLCs have a default tax status with the IRS depending on how many members there are.

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

Alternatively you can tell the.

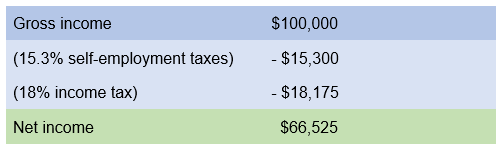

. Instead you only pay payroll taxes on the salary you earn from your S corp. Wages deductions and payroll taxes completed automatically. The other 30000 will still be subject to income tax but not Medicare or Social.

A computer is a digital electronic machine that can be programmed to carry out sequences of arithmetic or logical operations computation automaticallyModern computers can perform generic sets of operations known as programsThese programs enable computers to perform a wide range of tasks. Access to our award-winning US-based customer service team. 10 years in academic writing.

These LLCs would be best to operate as a default LLC. Determine withholdings and deductions for your employees in any state with Incfiles simple payroll tax calculator. Always remember for both the Sole Proprietorship and the S Corp all profits pass through to your personal taxes.

Employment Payroll and Self-Employment Tax. For some LLCs the cost of hiring a payroll service and bookkeeper would outweigh the financial tax advantages of electing S corp tax classification. It typically takes 2 minutes or less to run payroll.

Regions offers a full spectrum of banking services. 12 point ArialTimes New Roman. It is closer to being like an employee in terms of the payroll.

Each year when you complete the income tax forms for your corporation or S corporation you must report corporate officer salaries if the corporations total receipts are 500000 or more. LLC Calculator to estimate whether electing S corp tax status makes sense. This is a tax levied on the salary of everyone in your business even if you are self-employed.

A computer system is a complete computer that includes the hardware. We have servers that operate 999 of the time. Lets look at some numbers to see how this works.

275 words page. Your self-employed health insurance deduction cannot exceed your portion of S corp income. Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business.

KaÅSX V2 TútÀCèr TºŠ ÒÐÅ ÙúÒÃt9ù8kµgõÄârÔ ô R¼Îð ØMô žÐÅ Ùn Q ê-zrU œBGÉ ºB ¼ LØDŒ U5ÎZGŵAsÈ ªÿeàfáÍyb 4ÛÆ3i ËÀù V ¾D69HÀJ8lÄH I UÌÕ öaþi5 yÿ³u0 I. If you have a Multi-Member LLC 2 or more owners then the IRS will tax it as a Partnership instead. In the US people often set up LLCs or possibly S or C Corp entities as the foundation.

Then you generally receive pay after the client handles tax withholding etc. Is an American business software company that specializes in financial softwareThe company is headquartered in Mountain View California and the CEO is Sasan GoodarziIntuits products include the tax preparation application TurboTax personal finance app Mint the small business accounting program QuickBooks the credit monitoring service Credit Karma and. In a W-2 arrangement you can simply provide the client with your personal info including Social Security number.

Reporting Officer Salaries to the IRS. We have encrypted all our databases. Visit us online or at one of our many bank branch locations for checking savings mortgages and more.

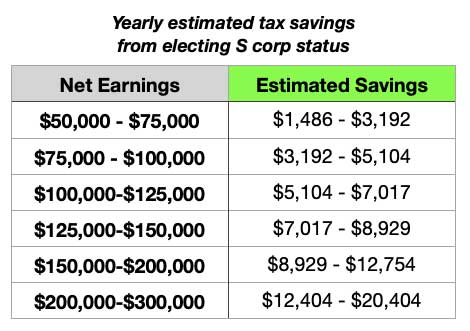

We give anonymity and confidentiality a first priority when it comes to dealing with clients personal information. As with larger corporations an S-corporation has both start-up and ongoing legal and accounting costs. S Corporations reduce your taxes by lessening the amount of payroll or self-employment tax you pay.

Alternately to avoid payroll issues you can reimburse for your personal use. Whether youre running a C corp S corp or an LLC a small business or a micro-business if youre an employer then you are responsible for paying four kinds of taxes. To elect for S-Corp treatment file Form 2553.

LLC Tax Classification with the IRS. If an LLC owner forfeits a salary he or she. Heres how your taxes stack up as a sole prop vs.

After electing S corp status an LLC owner uses profits to pay salaries and distributions to owner-employees. Calculating payroll deductions doesnt have to be a headache. But if your business is taxed as an S-corp youll only pay payroll taxes on your reasonable salary of 70000.

What advantages do you get from our course help online services. S Corp Savings Calculator. An S-corp or S-corporation is a tax status allowing business owners a flexible way to start small and grow.

9712 orders delivered before the deadline. For example in California an S-corporation must pay tax of 15 percent on its income with a minimum annual amount of 800. However they are treated differently once they get there.

If you have a Single-Member LLC 1 owner then the IRS will tax it as a Disregarded EntitySole Proprietorship. Our guide will help you get started. The S Corporation tax calculator below lets you choose how much to withdraw from.

To convert to an S-corp you will need to file IRS Form 2553For the tax election to have effect for the full year the form may be filed anytime in the previous year until. If S-Corp heres what the IRS says. All our clients personal information is stored safely.

The business must make at least 60000 in earnings be able to cover a reasonable salary and have at least 20000 in annual distributions for the S corp election to make financial sense. Money that you take out as a distribution is not subject to the 153 percent payroll or self-employment tax whereas your regular salary payments are. You can make this election at the same time you file your taxes by filing Form 1120S attaching Form 2533 and submitting along with your personal tax return.

Use our S Corp vs. How an S Corporation Saves You Money. There are two parts of this tax that paid by the employer and that paid by the employee.

In some states S-corporations must also pay additional fees and taxes. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right the first time around. Profit and Distribution.

SECA vs S Corp FICA Payroll Taxes. The S Corp Tax Calculator. File IRS Form 2553.

Updated with current IRS withholding information for 2018. Double and single spacing. 85 10 average quality score from customers.

Sole Proprietors and partnerships are covered by an employment tax called SECA while S Corp owners pay into a similar program called FICA. You can then deduct all vehicle cost on S-Corp. Review your writers samples.

This tax is not required for sole proprietors. Say you earn 150000 in revenue as the owner of a consulting firm. For personal mileage the cost can use standard mileage rate must be added to your W-2 along with gross up for FICA and Medicare taxes.

Say you own 25 of an S corp which earned 50000 last year.

Payroll Calculator With Pay Stubs For Excel

S Corp Vs Llc Everything You Need To Know

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

The Basics Of S Corporation Stock Basis

S Corp Tax Savings Calculator

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Reasonable Compensation Calculator Wageoptimizer

S Corp Payroll Taxes Requirements How To Calculate More

Payroll Calculator Free Employee Payroll Template For Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Payroll Calculator Free Employee Payroll Template For Excel

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp